Now Reading: How 2025 Sanctions Changed the Global Semiconductor Supply Chain

-

01

How 2025 Sanctions Changed the Global Semiconductor Supply Chain

How 2025 Sanctions Changed the Global Semiconductor Supply Chain

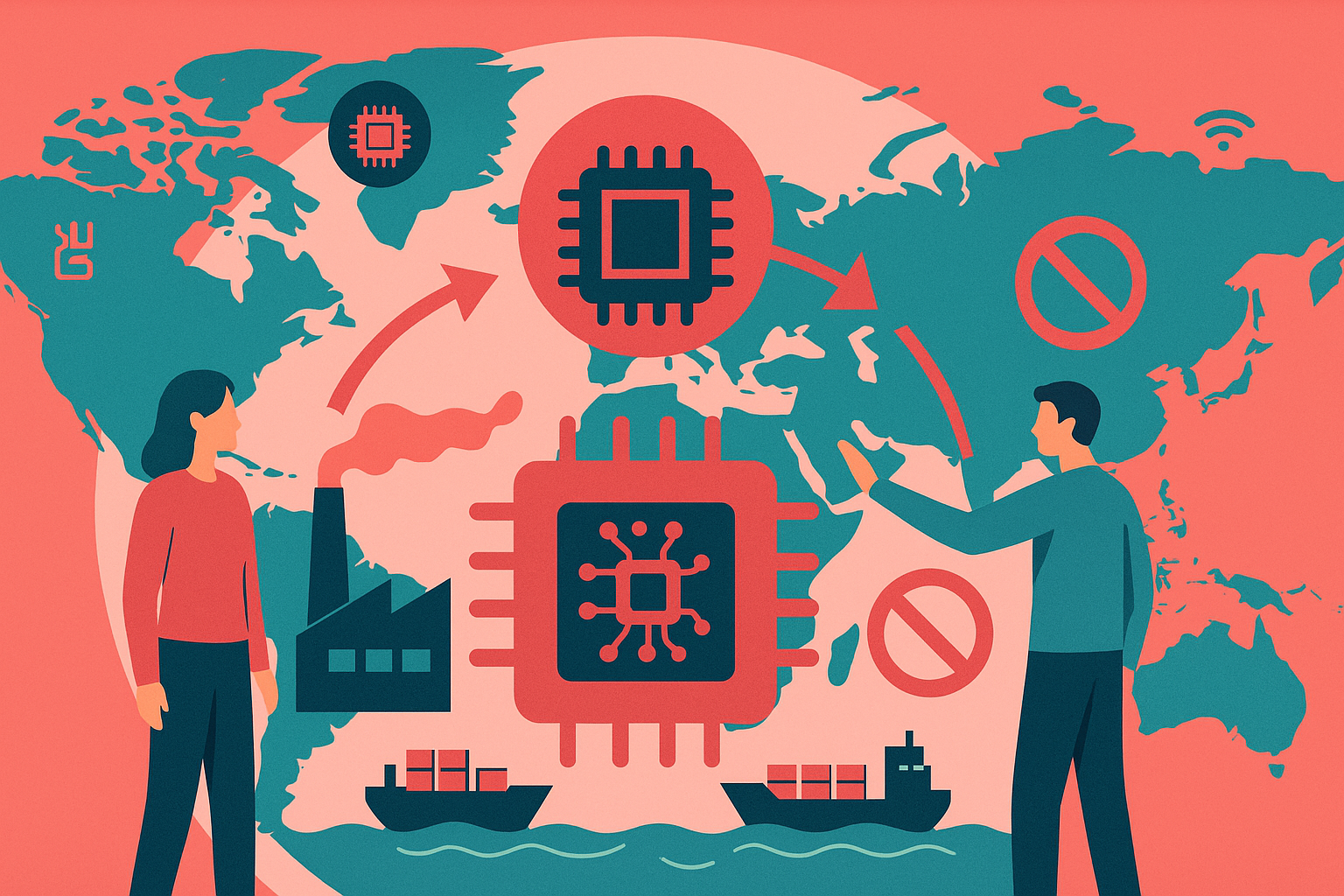

In 2025, geopolitical tensions and the resulting economic sanctions significantly reshaped the global semiconductor supply chain. These changes highlighted vulnerabilities within global trade dependencies and prompted shifts toward self-reliance, regional cooperation, and technological innovation.

Key Drivers of Change

- Geopolitical Tensions: Escalating trade disputes, primarily between major economies like the U.S., China, and the European Union, triggered strict sanctions impacting semiconductor supplies.

- Technological Sovereignty: Countries accelerated efforts to reduce dependency on foreign suppliers by boosting domestic semiconductor production capabilities.

- Supply Chain Resilience: Companies adopted diversified sourcing and reshored manufacturing practices to minimize disruption risks from geopolitical shocks.

Major Impacts on Industry

- Shift to Regional Production Hubs

- Sanctions encouraged semiconductor manufacturing localization, notably in the U.S., Europe, and East Asia. The EU, under its Chips Act initiative, committed over €45 billion to expand local semiconductor production.

- Acceleration in Technological Development

- Investments surged into innovative semiconductor technologies like EUV lithography, advanced node manufacturing, and novel materials. Companies like ASML and TSMC led breakthroughs, enhancing capabilities and reducing foreign dependencies.

- Rising Costs and Shortages

- Short-term disruptions caused supply shortages and increased prices for key industries, notably automotive, consumer electronics, and telecommunications. These sectors saw temporary production delays, affecting global markets and pricing strategies.

Case Examples

- Intel and GlobalFoundries: Accelerated their expansions in Europe and North America, capitalizing on regional incentives and strategic investment programs.

- TSMC: Expanded significantly outside Taiwan, notably in the United States and Japan, to hedge against geopolitical risk.

Expert Analysis and Insights

Industry analysts from Gartner emphasized that long-term strategic adjustments made in response to the sanctions would strengthen global semiconductor supply resilience by 2030. Additionally, McKinsey’s semiconductor report highlighted that these disruptions could potentially lead to technological innovation acceleration and increased investment in localized semiconductor ecosystems.

Expert Resources for Further Insights

For deeper insights into semiconductor market trends, consider these expert resources:

- Gartner Insights

- McKinsey Semiconductor Analysis

- Semiconductor Industry Association (SIA)

- IEEE Spectrum

- Electronics Weekly

Key Takeaways

The sanctions imposed in 2025 marked a critical turning point, prompting a strategic rethink across the semiconductor industry. This has ultimately catalyzed innovation, regional economic development, and enhanced resilience in global supply chains. Stakeholders across various industries should adapt proactively to these changing dynamics to maintain competitiveness and secure semiconductor supplies.